목차

[Python] yfinance 함수: 차트 정보 가져오기

파이썬 yfinance 함수를 사용해서 야후 파이낸스(Yahoo Finance)의 차트(Chart)의 주가 정보를 가져오겠습니다. (시작가, 종가, etc). yfinance 는 판다스(Pandas)의 Dataframe 함수를 지원합니다. Pandas는 테이블 형식으로 데이터를 정리하여 여러 처리를 쉽게 해주는 라이브러리라고 생각하시면 됩니다.

yfinance의 return으로 나온 결과 값은 dataframe 형태이므로 추후에 데이터 분석을 할 경우 dataframe의 내부 함수들을 알고 있다면 쉽게 변경 사용할 수 있습니다.

코드 실행에 앞서 아래와 같이 라이브러리 설치를 합니다.

pip install pandas_datareader

pip install yfinance

설치 후에도 코드 실행시 아래와 같은 에러메세지가 발생한다면 xx 모듈을 pip install 명령어를 사용하여서 설치하시면 됩니다.

ModuleNotFoundError: No module named '모듈명'

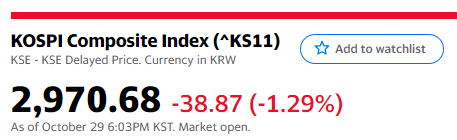

예제 코드에서는 Kospi(코스피) 정보를 가져오겠습니다. 아래 그림처럼 야후 금융에서 Ticker 값을 확인하니 ^KS11 임을 알 수 있었습니다.

코드>>

from pandas_datareader import data as pdr

import yfinance as yf

yf.pdr_override()

data = pdr.get_data_yahoo("^KS11", start="2020-01-01", end="2021-01-01")

print(data)

결과>>

[*********************100%***********************] 1 of 1 completed

Open High Low Close Adj Close Volume

Date

2020-01-02 2201.209961 2202.320068 2171.840088 2175.169922 2175.169922 494700

2020-01-03 2192.580078 2203.379883 2165.389893 2176.459961 2176.459961 631600

2020-01-06 2154.969971 2164.419922 2149.949951 2155.070068 2155.070068 592700

2020-01-07 2166.600098 2181.620117 2164.270020 2175.540039 2175.540039 568200

2020-01-08 2156.270020 2162.320068 2137.719971 2151.310059 2151.310059 913800

... ... ... ... ... ... ...

2020-12-23 2737.739990 2769.080078 2716.280029 2759.820068 2759.820068 1121300

2020-12-24 2762.600098 2812.159912 2762.600098 2806.860107 2806.860107 1030900

2020-12-28 2820.949951 2834.590088 2799.560059 2808.600098 2808.600098 1006200

2020-12-29 2810.550049 2823.439941 2792.060059 2820.510010 2820.510010 1046800

2020-12-30 2820.360107 2878.209961 2809.350098 2873.469971 2873.469971 1074000

[248 rows x 6 columns]

주석>>

3번 라인 : 의미에 대해서는 별도의 설명은 없지만 차트 값을 불러올 때 필요한 최소한의 로딩으로 보시면 됩니다.

5번 라인 : 입력값으로 "Ticker(티커명)", start(시작일), end(종료일) 값을 입력하고 해당 범위의 티커 값을 불러 옵니다. 여기서는 2020년 1년간의 데이터를 불러 왔습니다.

6번 라인 : 데이터 결과량이 많아 head 5줄과 tail 5줄로 표기 됩니다. 만일 전체 결과를 확인하고 싶을 경우 print(data.to_string()) 를 입력하시면 됩니다.

[Python] yfinance 함수: info함수 회사 요약 정보 불러오기(Tesla)

코드>>

import yfinance as yf

tlsa_yf = yf.Ticker("TSLA")

tlsa_info = tlsa_yf.info

print(tlsa_info)

결과>>

{'zip': '94304', 'sector': 'Consumer Cyclical', 'fullTimeEmployees': 70757, 'longBusinessSummary': 'Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and

storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well

as sells automotive regulatory credits. It provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; and purchase financing and leasing services. This segment is also involved in the provision of non-warranty after-sales vehicle services, sale of used vehicles, retail merchandise, and vehicle insurance, as well as sale of products through its subsidiaries to third party customers; services for electric vehicles through its company-owned service locations, and Tesla mobile service technicians; and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners. This segment also offers service and repairs to its energy product customers, including under warranty; and various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was founded in 2003 and is headquartered in Palo Alto, California.', 'city': 'Palo Alto', 'phone': '650-681-5000', 'state': 'CA', 'country': 'United States', 'companyOfficers': [], 'website': 'http://www.tesla.com', 'maxAge': 1, 'address1': '3500 Deer Creek Road', 'industry': 'Auto Manufacturers', 'ebitdaMargins': 0.15512, 'profitMargins': 0.07403, 'grossMargins': 0.23107, 'operatingCashflow': 9930999808, 'revenueGrowth': 0.568, 'operatingMargins': 0.09789, 'ebitda': 7266999808, 'targetLowPrice': 67, 'recommendationKey': 'hold', 'grossProfits': 6630000000, 'freeCashflow': 4644624896, 'targetMedianPrice': 855, 'currentPrice': 1114, 'earningsGrowth': 4.333, 'currentRatio': 1.385, 'returnOnAssets': 0.055370003, 'numberOfAnalystOpinions': 36, 'targetMeanPrice': 779.34, 'debtToEquity': 35.65, 'returnOnEquity': 0.15641, 'targetHighPrice': 1300, 'totalCash': 16094999552, 'totalDebt': 10158000128, 'totalRevenue': 46848000000, 'totalCashPerShare': 16.027, 'financialCurrency': 'USD', 'revenuePerShare': 48.272, 'quickRatio': 1.002, 'recommendationMean': 2.6, 'exchange': 'NMS', 'shortName': 'Tesla, Inc.', 'longName': 'Tesla, Inc.', 'exchangeTimezoneName': 'America/New_York', 'exchangeTimezoneShortName': 'EDT', 'isEsgPopulated': False, 'gmtOffSetMilliseconds': '-14400000', 'quoteType': 'EQUITY', 'symbol': 'TSLA', 'messageBoardId': 'finmb_27444752', 'market': 'us_market', 'annualHoldingsTurnover': None, 'enterpriseToRevenue': 23.784, 'beta3Year': None, 'enterpriseToEbitda': 153.331, '52WeekChange': 1.7814536, 'morningStarRiskRating': None, 'forwardEps': 7.91, 'revenueQuarterlyGrowth': None, 'sharesOutstanding': 1004259968, 'fundInceptionDate': None, 'annualReportExpenseRatio': None, 'totalAssets': None, 'bookValue': 26.945, 'sharesShort': 30337020, 'sharesPercentSharesOut': 0.030199999, 'fundFamily': None, 'lastFiscalYearEnd': 1609372800, 'heldPercentInstitutions': 0.41202998, 'netIncomeToCommon': 3468000000, 'trailingEps': 3.062, 'lastDividendValue': None, 'SandP52WeekChange': 0.39125264, 'priceToBook': 41.34348, 'heldPercentInsiders': 0.18979, 'nextFiscalYearEnd': 1672444800, 'yield': None, 'mostRecentQuarter': 1632960000, 'shortRatio': 1.6, 'sharesShortPreviousMonthDate': 1631664000, 'floatShares': 815824595, 'beta': 1.89365, 'enterpriseValue': 1114254999552, 'priceHint': 2, 'threeYearAverageReturn': None, 'lastSplitDate': 1598832000, 'lastSplitFactor': '5:1', 'legalType': None, 'lastDividendDate': None, 'morningStarOverallRating': None, 'earningsQuarterlyGrowth': 3.888, 'priceToSalesTrailing12Months': 23.88033, 'dateShortInterest': 1634256000, 'pegRatio': 2.44, 'ytdReturn': None, 'forwardPE': 140.8344, 'lastCapGain': None, 'shortPercentOfFloat': 0.0372, 'sharesShortPriorMonth': 26999741, 'impliedSharesOutstanding': None, 'category': None, 'fiveYearAverageReturn': None, 'previousClose': 1077.04, 'regularMarketOpen': 1081.86, 'twoHundredDayAverage': 708.0305, 'trailingAnnualDividendYield': None, 'payoutRatio': 0, 'volume24Hr': None, 'regularMarketDayHigh': 1115.13, 'navPrice': None, 'averageDailyVolume10Day': 39294100, 'regularMarketPreviousClose': 1077.04, 'fiftyDayAverage': 830.86743, 'trailingAnnualDividendRate': None, 'open': 1081.86, 'toCurrency': None, 'averageVolume10days': 39294100, 'expireDate': None, 'algorithm': None, 'dividendRate': None, 'exDividendDate': None, 'circulatingSupply': None, 'startDate': None, 'regularMarketDayLow': 1073.205, 'currency': 'USD', 'trailingPE': 363.81448, 'regularMarketVolume': 29918867, 'lastMarket': None, 'maxSupply': None, 'openInterest': None, 'marketCap': 1118745657344, 'volumeAllCurrencies': None, 'strikePrice': None, 'averageVolume': 20309168, 'dayLow': 1073.205, 'ask': 1128.15, 'askSize': 1100, 'volume': 29918867, 'fiftyTwoWeekHigh': 1115.21, 'fromCurrency': None, 'fiveYearAvgDividendYield': None, 'fiftyTwoWeekLow': 392.3, 'bid': 1128, 'tradeable': False, 'dividendYield': None, 'bidSize': 1000, 'dayHigh': 1115.13, 'regularMarketPrice': 1114, 'preMarketPrice': None, 'logo_url': 'https://logo.clearbit.com/tesla.com'}

주석>>

5번 라인: info 내장 함수를 통해 회사의 요약 정보를 가져 올 수 있습니다.

[Python] yfinance 함수: action함수 회사 배당,분할 정보 불러오기(Tesla)

코드>>

import yfinance as yf

tlsa_yf = yf.Ticker("TSLA")

tlsa_data = tlsa_yf.actions

print(tlsa_data)

결과>>

Dividends Stock Splits

Date

2020-08-31 0.0 5.0

주석>>

5번 라인: action 함수를 사용해서 회사의 배당(dividends), 주식 분할(Stock splits) 사례가 있으면 불러옵니다. 아래와 같이 각 각 별도로 사용 가능합니다.

import yfinance as yf

tlsa_yf = yf.Ticker("TSLA")

tlsa_data = tlsa_yf.dividends

print(tlsa_data)

tlsa_data = tlsa_yf.splits

print(tlsa_data)

[Python] yfinance 함수: financial, major_holder함수 회사 재무제표, 주주정보(Tesla)

코드>>

import yfinance as yf

tlsa_yf = yf.Ticker("TSLA")

tlsa_data = tlsa_yf.financials

print(tlsa_data)

print("#############################")

tlsa_data = tlsa_yf.major_holders

print(tlsa_data)

결과>>

2020-12-31 2019-12-31 2018-12-31 2017-12-31

Research Development 1491000000.0 1343000000.0 1460000000.0 1378000000.0

Effect Of Accounting Charges None None None None

Income Before Tax 1154000000.0 -665000000.0 -1005000000.0 -2209000000.0

Minority Interest 1454000000.0 1492000000.0 1390000000.0 1395080000.0

Net Income 721000000.0 -862000000.0 -976000000.0 -1962000000.0

Selling General Administrative 3188000000.0 2646000000.0 2835000000.0 2477000000.0

Gross Profit 6630000000.0 4069000000.0 4042000000.0 2223000000.0

Ebit 1951000000.0 80000000.0 -253000000.0 -1632000000.0

Operating Income 1951000000.0 80000000.0 -253000000.0 -1632000000.0

Other Operating Expenses None None None None

Interest Expense -784000000.0 -725000000.0 -653000000.0 -477000000.0

Extraordinary Items None None None None

Non Recurring None None None None

Other Items None None None None

Income Tax Expense 292000000.0 110000000.0 58000000.0 32000000.0

Total Revenue 31536000000.0 24578000000.0 21461000000.0 11759000000.0

Total Operating Expenses 29585000000.0 24498000000.0 21714000000.0 13391000000.0

Cost Of Revenue 24906000000.0 20509000000.0 17419000000.0 9536000000.0

Total Other Income Expense Net -797000000.0 -745000000.0 -752000000.0 -577000000.0

Discontinued Operations None None None None

Net Income From Continuing Ops 862000000.0 -775000000.0 -1063000000.0 -2241000000.0

Net Income Applicable To Common Shares 690000000.0 -870000000.0 -976000000.0 -1962000000.0

#############################

0 1

0 18.98% % of Shares Held by All Insider

1 41.20% % of Shares Held by Institutions

2 50.85% % of Float Held by Institutions

3 2756 Number of Institutions Holding Shares

주석>>

5번 라인: financial 함수를 사용해서 1년간의 재무제표 수익 구조를 확인할 수 있습니다.

10번 라인 : major_holders 함수를 사용해서 주요 주주 정보를 가져 올 수 있습니다.

[Python] yfinance 함수: institutional_holders, balance_sheet, cashflow, earnings함수(Tesla)

- institutional_holders : 기업 주주 정보

- balance_sheet : 대차 대조표

- cashflow : 현금흐름표

- earnings : 기업 실적

코드>>

import yfinance as yf

tlsa_yf = yf.Ticker("TSLA")

tlsa_data = tlsa_yf.institutional_holders

print(tlsa_data)

print("#############################")

tlsa_data = tlsa_yf.balance_sheet

print(tlsa_data)

print("#############################")

tlsa_data = tlsa_yf.cashflow

print(tlsa_data)

print("#############################")

tlsa_data = tlsa_yf.earnings

print(tlsa_data)

결과>>

Holder Shares Date Reported % Out Value

0 Vanguard Group, Inc. (The) 58931414 2021-06-29 0.0587 40055682095

1 Blackrock Inc. 50452309 2021-06-29 0.0502 34292434427

2 Capital World Investors 37282565 2021-06-29 0.0371 25340959430

3 State Street Corporation 29828814 2021-06-29 0.0297 20274644875

4 Baillie Gifford and Company 13853124 2021-09-29 0.0138 10742820599

5 Geode Capital Management, LLC 12311100 2021-06-29 0.0123 8367854670

6 Jennison Associates LLC 10332413 2021-06-29 0.0103 7022941116

7 FMR, LLC 9575696 2021-06-29 0.0095 6508600571

8 Northern Trust Corporation 8166550 2021-06-29 0.0081 5550804035

9 Norges Bank Investment Management 7790070 2020-12-30 0.0078 5497218696

#############################

2020-12-31 2019-12-31 2018-12-31 2017-12-31

Intangible Assets 3.130000e+08 3.390000e+08 2.820000e+08 3.615020e+08

Capital Surplus 2.726000e+10 1.273600e+10 1.024900e+10 9.178024e+09

Total Liab 2.846900e+10 2.619900e+10 2.342700e+10 2.302305e+10

Total Stockholder Equity 2.222500e+10 6.618000e+09 4.923000e+09 4.237242e+09

Minority Interest 1.454000e+09 1.492000e+09 1.390000e+09 1.395080e+09

Other Current Liab 4.147000e+09 3.693000e+09 2.955000e+09 3.098379e+09

Total Assets 5.214800e+10 3.430900e+10 2.974000e+10 2.865537e+10

Common Stock 1.000000e+06 1.000000e+06 NaN 1.690000e+05

Other Current Assets 2.380000e+08 2.460000e+08 1.930000e+08 1.553230e+08

Retained Earnings -5.399000e+09 -6.083000e+09 -5.318000e+09 -4.974299e+09

Other Liab 3.302000e+09 2.969000e+09 2.318000e+09 4.196294e+09

Good Will 2.070000e+08 1.980000e+08 6.800000e+07 6.023700e+07

Treasury Stock 3.630000e+08 -3.600000e+07 -8.000000e+06 3.334800e+07

Other Assets 1.536000e+09 1.469000e+09 1.380000e+09 1.166193e+09

Cash 1.938400e+10 6.268000e+09 3.686000e+09 3.367914e+09

Total Current Liabilities 1.424800e+10 1.066700e+10 9.993000e+09 7.674740e+09

Short Long Term Debt 1.758000e+09 1.399000e+09 2.284000e+09 9.639320e+08

Other Stockholder Equity 3.630000e+08 -3.600000e+07 -8.000000e+06 3.334800e+07

Property Plant Equipment 2.337500e+10 2.019900e+10 1.969100e+10 2.049162e+10

Total Current Assets 2.671700e+10 1.210300e+10 8.307000e+09 6.570520e+09

Net Tangible Assets 2.170500e+10 6.081000e+09 4.573000e+09 3.815503e+09

Net Receivables 1.903000e+09 1.324000e+09 9.490000e+08 5.153810e+08

Long Term Debt 8.571000e+09 1.037500e+10 8.461000e+09 9.486248e+09

Inventory 4.101000e+09 3.552000e+09 3.113000e+09 2.263537e+09

Accounts Payable 6.051000e+09 3.771000e+09 3.405000e+09 2.390250e+09

Long Term Investments NaN 1.000000e+06 1.200000e+07 5.304000e+06

#############################

2020-12-31 2019-12-31 2018-12-31 2017-12-31

Change To Liabilities 2.423000e+09 1.447000e+09 2.203000e+09 8.570000e+08

Total Cashflows From Investing Activities -3.132000e+09 -1.436000e+09 -2.337000e+09 -4.196000e+09

Net Borrowings -2.488000e+09 7.980000e+08 8.900000e+07 3.385000e+09

Total Cash From Financing Activities 9.973000e+09 1.529000e+09 5.740000e+08 4.415000e+09

Change To Operating Activities -1.165000e+09 -1.000000e+09 -6.250000e+08 -1.150000e+09

Issuance Of Stock 1.268600e+10 1.111000e+09 2.960000e+08 6.590000e+08

Net Income 7.210000e+08 -8.620000e+08 -9.760000e+08 -1.962000e+09

Change In Cash 1.311800e+10 2.506000e+09 3.120000e+08 1.980000e+08

Effect Of Exchange Rate 3.340000e+08 8.000000e+06 -2.300000e+07 4.000000e+07

Total Cash From Operating Activities 5.943000e+09 2.405000e+09 2.098000e+09 -6.100000e+07

Depreciation 2.322000e+09 2.092000e+09 1.888000e+09 1.636000e+09

Other Cashflows From Investing Activities 1.230000e+08 4.600000e+07 4.600000e+07 4.600000e+07

Change To Inventory -4.220000e+08 -4.290000e+08 -1.023000e+09 -1.790000e+08

Change To Account Receivables -6.520000e+08 -3.670000e+08 -4.970000e+08 -2.500000e+07

Other Cashflows From Financing Activities -2.250000e+08 -3.800000e+08 1.890000e+08 3.710000e+08

Change To Netincome 2.536000e+09 1.336000e+09 9.690000e+08 6.710000e+08

Capital Expenditures -3.232000e+09 -1.432000e+09 -2.319000e+09 -4.081000e+09

#############################

Revenue Earnings

Year

2017 11759000000 -1962000000

2018 21461000000 -976000000

2019 24578000000 -862000000

2020 31536000000 721000000

[Python] yfinance 함수: 특정 값 불러오고 수정하기

코드>>

import yfinance as yf

tlsa_yf = yf.Ticker("TSLA")

tlsa_data = tlsa_yf.institutional_holders

print(type(tlsa_data))

print(tlsa_data)

tlsa_data["Shares"][0] = 77777

print(tlsa_data)

결과>>

<class 'pandas.core.frame.DataFrame'>

Holder Shares Date Reported % Out Value

0 Vanguard Group, Inc. (The) 58931414 2021-06-29 0.0587 40055682095

1 Blackrock Inc. 50452309 2021-06-29 0.0502 34292434427

2 Capital World Investors 37282565 2021-06-29 0.0371 25340959430

3 State Street Corporation 29828814 2021-06-29 0.0297 20274644875

4 Baillie Gifford and Company 13853124 2021-09-29 0.0138 10742820599

5 Geode Capital Management, LLC 12311100 2021-06-29 0.0123 8367854670

6 Jennison Associates LLC 10332413 2021-06-29 0.0103 7022941116

7 FMR, LLC 9575696 2021-06-29 0.0095 6508600571

8 Northern Trust Corporation 8166550 2021-06-29 0.0081 5550804035

9 Norges Bank Investment Management 7790070 2020-12-30 0.0078 5497218696

c:\Users\forgo\Documents\python_ex\py_test\vix_analyzer.py:8: SettingWithCopyWarning:

A value is trying to be set on a copy of a slice from a DataFrame

See the caveats in the documentation: https://pandas.pydata.org/pandas-docs/stable/user_guide/indexing.html#returning-a-view-versus-a-copy

tlsa_data["Shares"][0] = 77777

Holder Shares Date Reported % Out Value

0 Vanguard Group, Inc. (The) 77777 2021-06-29 0.0587 40055682095

1 Blackrock Inc. 50452309 2021-06-29 0.0502 34292434427

2 Capital World Investors 37282565 2021-06-29 0.0371 25340959430

3 State Street Corporation 29828814 2021-06-29 0.0297 20274644875

4 Baillie Gifford and Company 13853124 2021-09-29 0.0138 10742820599

5 Geode Capital Management, LLC 12311100 2021-06-29 0.0123 8367854670

6 Jennison Associates LLC 10332413 2021-06-29 0.0103 7022941116

7 FMR, LLC 9575696 2021-06-29 0.0095 6508600571

8 Northern Trust Corporation 8166550 2021-06-29 0.0081 5550804035

9 Norges Bank Investment Management 7790070 2020-12-30 0.0078 5497218696

주석>>

6번 라인 : 결과 type을 확인하였습니다. 판다스(Pandas) Dataframe임을 알 수 있습니다.

Dataframe 사용에 대해 궁금하시면 아래 링크를 참조하시면 됩니다.

https://scribblinganything.tistory.com/371

[Python] Pandas DataFrames이란? 선언, 데이터 찾기, 정렬하기 예제

목차 [Python] Pandas DataFrames이란? 파이썬의 판다스는 데이터 처리에 용이한 라이브러리 입니다. 앞서 설명한 Pandas Series와 마찬가지로 DataFrames은 데이터를 엑셀과 비슷한 방식으로 관리하기 위해

scribblinganything.tistory.com

8번 라인: 행과 열의 값을 테이블 형식으로 입력하면 값을 불러오거나 수정할 수 있습니다.

'파이썬(Python) > 웹스크롤링' 카테고리의 다른 글

| [Python] 네이버 금융 주식 정보 가져오기 (ex. 삼성전자) (0) | 2021.11.09 |

|---|---|

| [Python] yfinance로 고점대비 하락율 그래프 그리기 (코스피, 코스닥, MDD) (0) | 2021.11.08 |

| [Python] BS4로 네이버금융 종목분석-재무분석 값 가져오기 (0) | 2021.10.27 |

| selenium 에러발생 시 해결방법 "selenium.common.exceptions.NoSuchElementException: Message: no such element: Unable to locate element" (4) | 2021.07.15 |

| 파이썬(Python) Selenium Click() 동작이 안될 때 (7) | 2021.03.31 |